Survey of the SEC market in Ukraine for 2017

The company AXOR INDUSTRY prepared a study of the market of metal-plastic structures of Ukraine for 2017. The review is formed taking into account the actual aspects of the activity on the basis of a survey of the heads of the largest industrial enterprises of the SEC in Ukraine.

Introduction

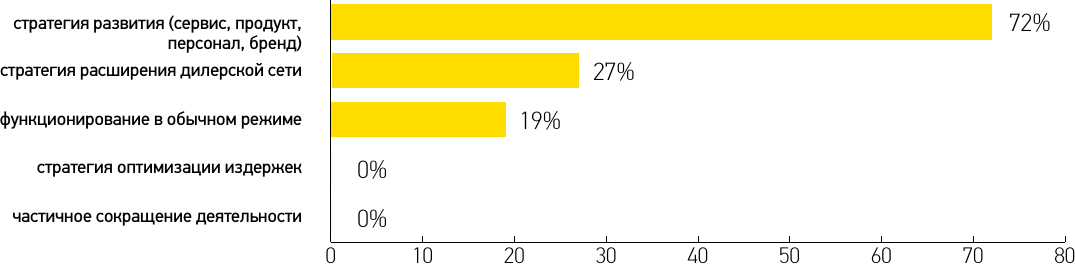

Positive dynamics of the development of the company's market in Ukraine allowed the window companies in 2017 to concentrate their efforts on the development of their product, brand and personnel.

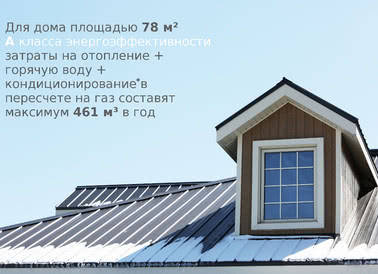

Energy saving programs continued to promote the market development in the reporting year: the government program, which resumed the issuance of loans in March 2017, and the EBRD's IQ Energy program, which is actively developing in the reporting year.

In the conditions of market development, the customer requirements for the product also reasonably increased. Along with energy-saving properties, constructions with safety features are gaining popularity. Products standardclass all the more confidently in the lead in sales.

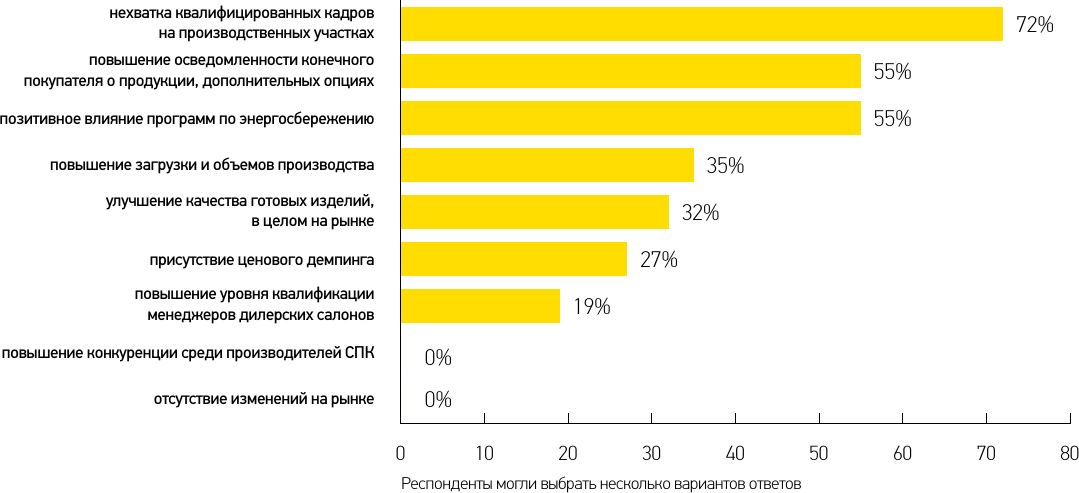

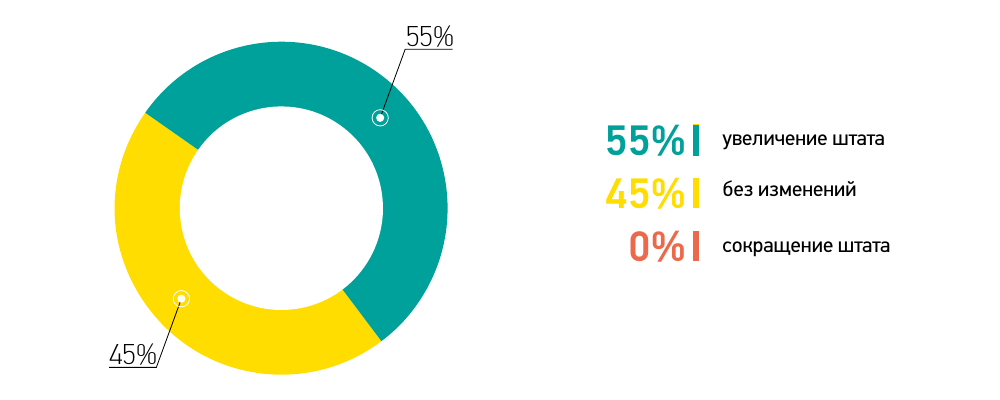

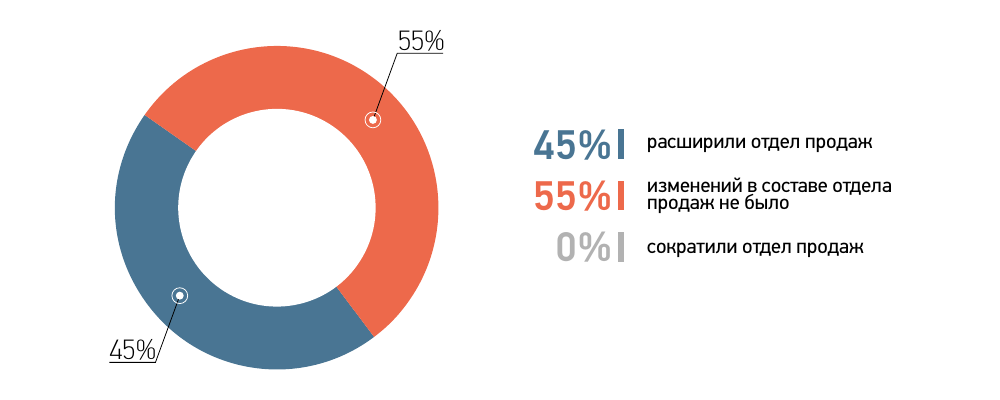

Personnel policy in 2017 was one of the topical issues. On the one hand, the companies managed to expand their staff (mainly increasing the number of employees in the sales department), on the other hand, the problem with the shortage of qualified personnel in production sites, which, apparently, will become even more acute in 2018, became more acute. p>

Expecting further growth in market volumes in 2018, most of the companies surveyed understand that the future is behind the development. Improvement of business processes in companies, modernization of production facilities, development of energy saving programs - these are the main "drivers" of the window industry. According to respondents, the development of the industry will continue, but only with one condition - economic stability in the country.

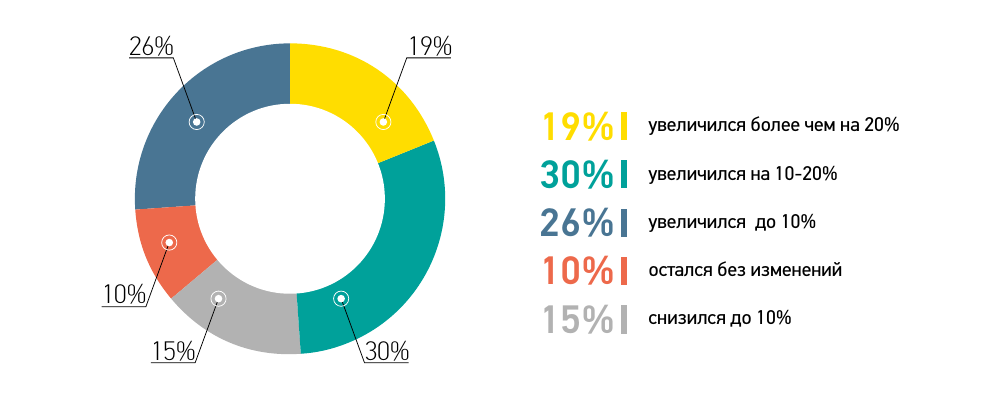

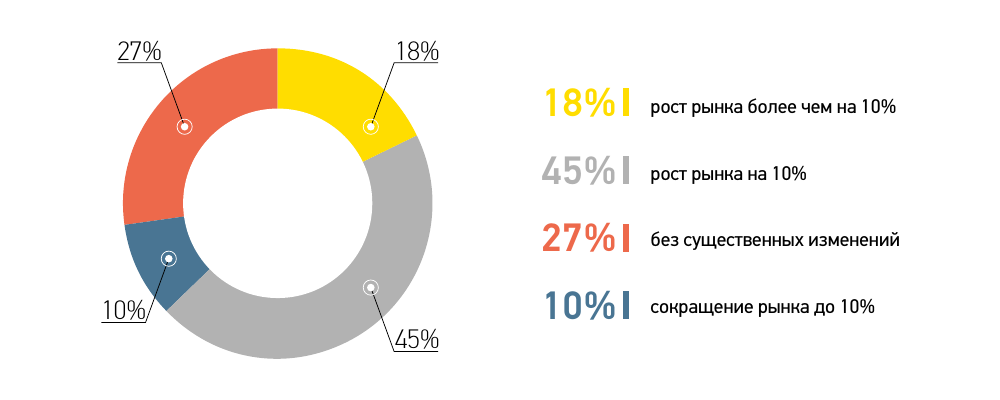

- 75% of the companies surveyed noted an increase in the volume of the SEC market in 2017 compared with the indicators of 2016

- 55% companies indicated that in the reporting year they expanded their company's staff, mainly increasing the number of employees in the sales department

- 72% companies noted a shortage of qualified personnel in production sites

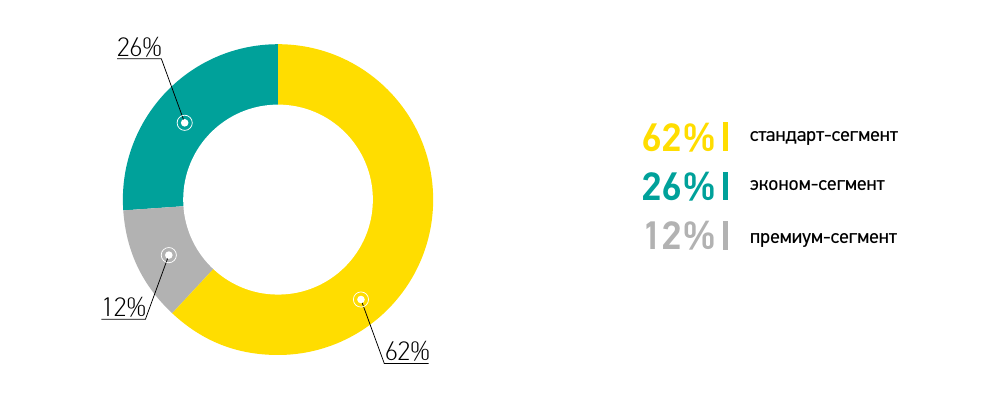

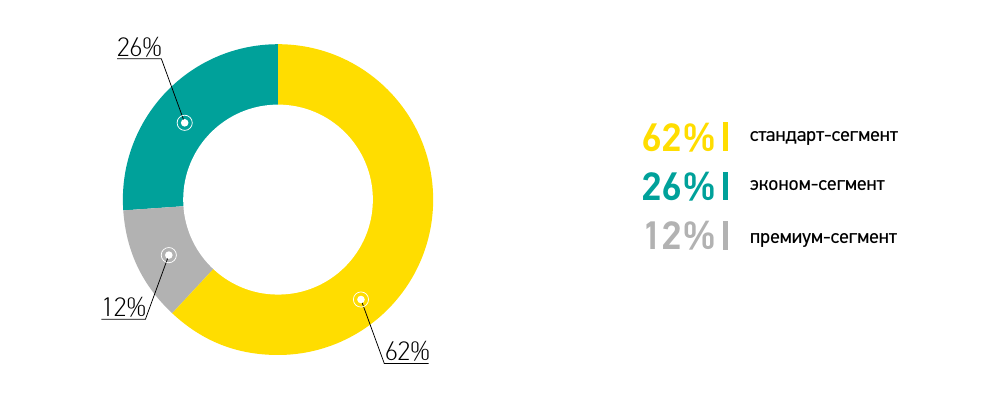

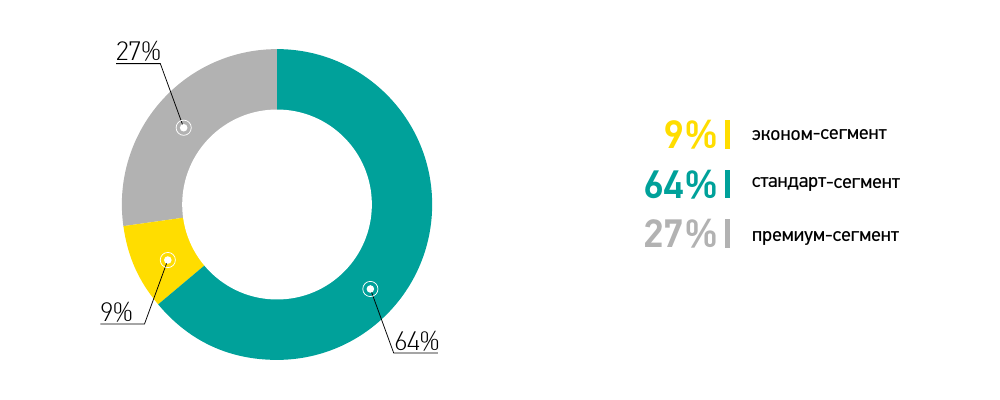

- 62% of companies indicated that in the reporting year, the products of the standard segment were leading in their sales volumes, and only 26% of respondents had economy class products

- 45% companies expect market growth in 2018, an average of 10%

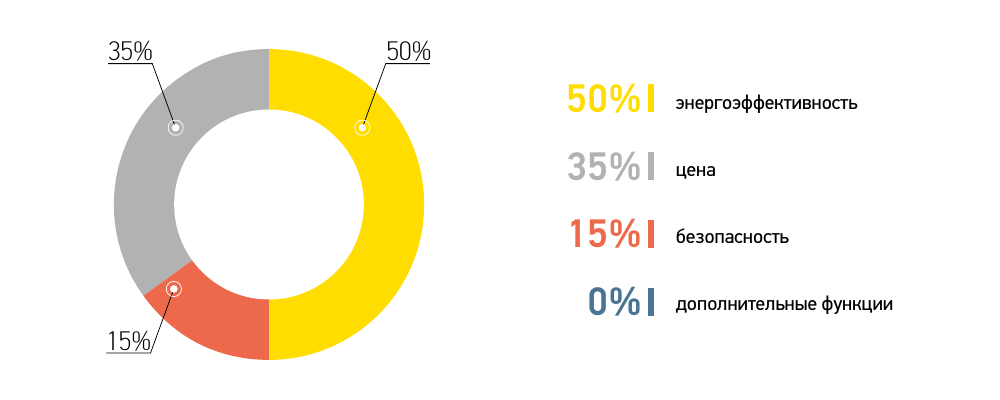

- 50% companies believe that energy efficiency will continue to be the main trend among consumers in 2018.

State of the art

2017 was quite positive and productive for the development of the window industry in Ukraine. This year, the leading companies-manufacturers of the SEC have focused their efforts on product and brand development, expanded the company's staff and added in sales volumes.

If at the beginning of the year the dynamics of the market development was sufficiently "restrained" and some companies even lost in volumes in comparison with last year, then the 2nd and 3rd quarters compensated this shortfall with a vengeance. Production, almost all companies, were loaded at full capacity. Orders were enough for all. Even the shaky exchange rate of the hryvnia and the increase in prices for some components, and, consequently, the growth in the price for finished goods did not prevent this.

From the "weaknesses" of the reporting year, as in other and previous years, the overwhelming majority of the interviewed companies (72%) noted the acute shortage of personnel in the production sites. This is a long-standing topic, but the active sales season has apparently exacerbated this situation. At the same time, the surveyed companies noted the increase in the qualifications of managers in dealerships in the reporting year, as well as raising the awareness of the final customer about products and options. The educational work of energy saving programs, joint efforts of manufacturing companies and their partners to train their personnel and employees of dealerships gave clear results. The conclusion is clear that the training and development of the staff is a productive future.

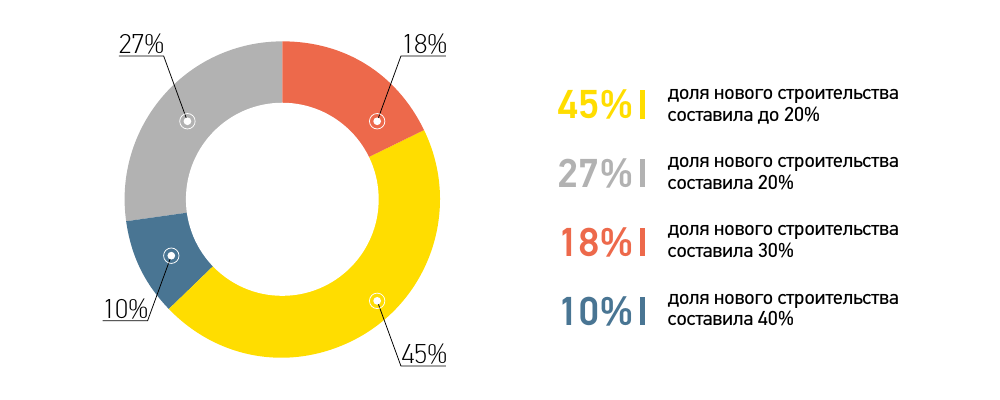

Another interesting point is the glazing of new buildings. Almost half of the surveyed companies (45%) noted that the share of glazing of new buildings in the reporting year was small - up to 20%. At the same time, another part of the respondents (55%) indicated this indicator in a different range - from 20% to 40% of the total glazing volume in the reporting year. From the above, it can be concluded that not all large companies-manufacturers of the SEC actively participate in the glazing of primary construction, paying more attention to the development of the dealer network. In general, comparing this indicator with the data of the previous year, it is worth noting that the proportion of the glazing of new buildings in 2017 is gradually increasing.

What is the most complete reflection of your company's activities in 2017?

How do you estimate the size of the SEC market in 2017 relative to 2016?

In your opinion, what was the proportion of the glazing of new construction in 2017 in terms of total market volume?

Which of the options offered can most accurately describe the window market in 2017?

Products

The rise in price of products due to rising prices for glass and PVC raw materials did not significantly affect the choice of the end user. In the reporting year, products of the standard segment were in the lead in sales among the majority of the companies surveyed. The economy class is in demand less and less. But premium products are slowly but surely gaining momentum. A more functional product that meets the requirements of energy saving and safety is becoming more popular.

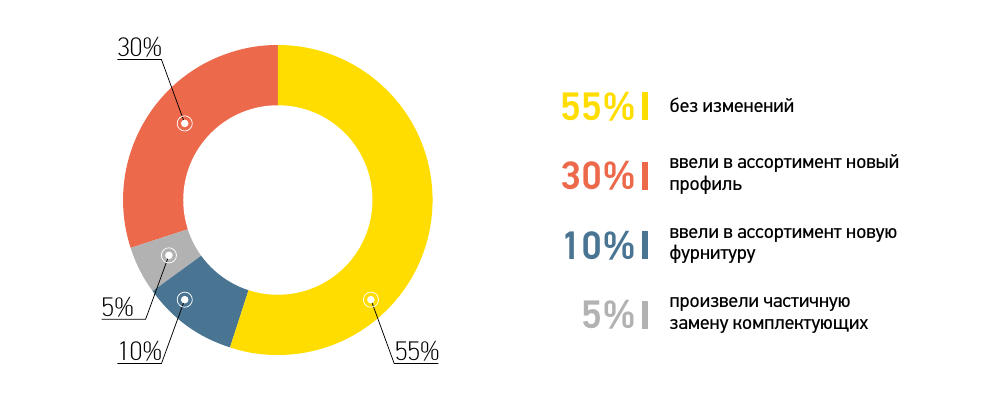

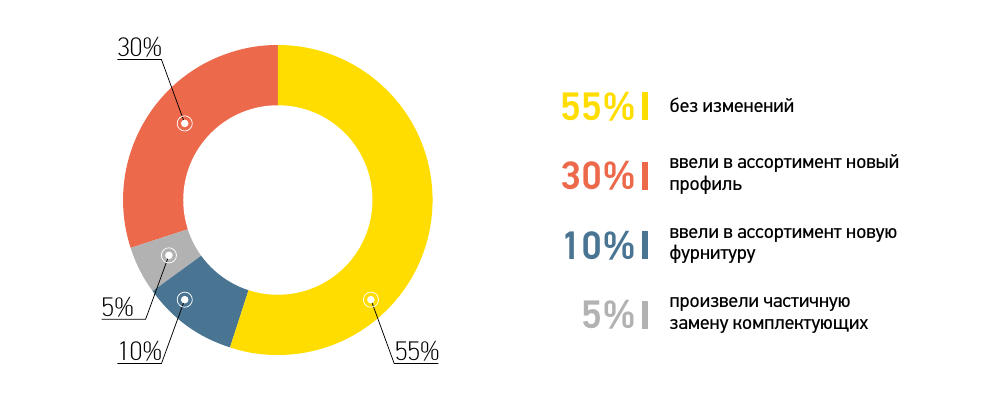

As for the assortment line of companies in 2017, according to the results of this analysis, as well as previous periods, it is clear that the majority of respondents have long decided on suppliers and for the most part do not plan to change supply partners.

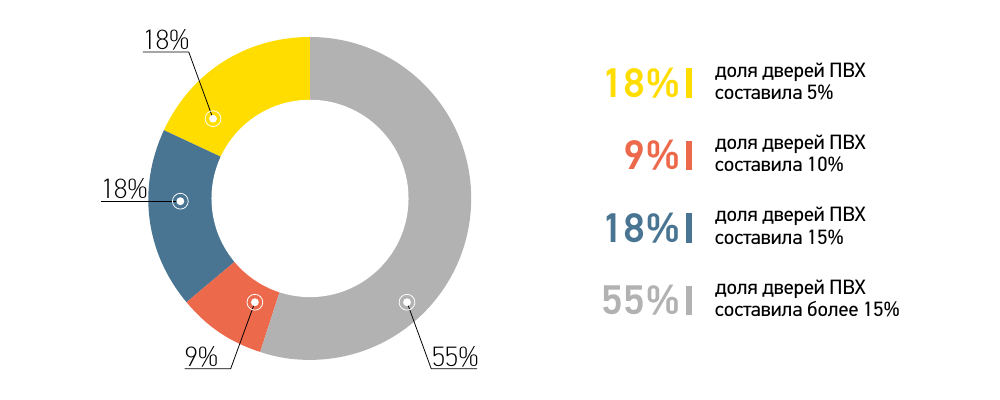

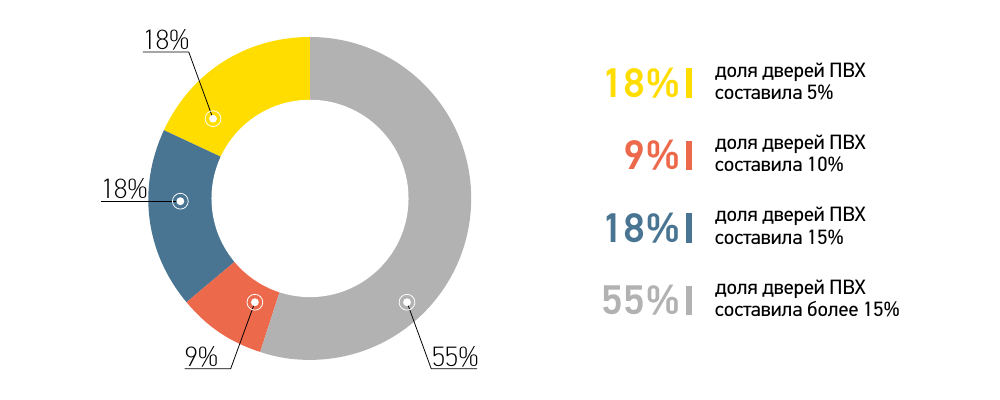

Interesting data are obtained from the statistics of sales of metal-plastic doors. Sales of entrance and interior doors of PVC from the total volume of sold products of companies this year exceeded 15%. (This was noted by most of the survey participants). Earlier in Ukraine, the share of such doors from the total number of sales of window structures was 8-10%. The demand for this type of products can be associated with an increase in the difference in the price of interior doors made of PVC in relation to aluminum and veneer doors - in favor of the former. Metal-plastic entrance and interior doors are increasingly installed in residential buildings, offices, warehouses and public buildings.

How has your assortment changed?

line 2017 in the year?

Chart AXOR

Chart AXOR

Which price segment products dominated your sales in 2017?

Chart AXOR

Chart AXOR

What share in your volumes was the sales of metal-plastic doors (entrance and interior, without balcony) in 2017?

Chart AXOR

Chart AXOR

Distribution channels and promotion

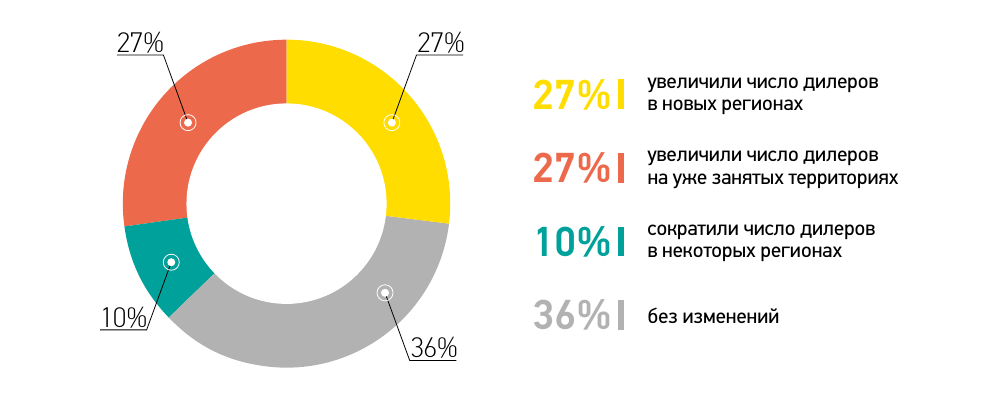

As mentioned above, for most of the production window companies in Ukraine, the dealer network is the main channel for the sale of its products. In 2017, almost half of SPK's manufacturing companies continued to "fight for their dealer", strengthening their positions in the occupied territories or increasing the number of dealers in new regions. A third of the companies retained the number of their outlets at the level of the previous year. Only 10% of respondents indicated a reduction in the number of their sales representatives.

Among effective tools in dealing with dealers in the reporting year, almost in equal shares were: motivational programs, training seminars and trainings, as well as actions. Moreover, joint actions with suppliers in the context of the whole year were more effective than independent ones, proving that common efforts set in one direction give the effect of synergy. Of course, the price factor was still relevant in working with partners.

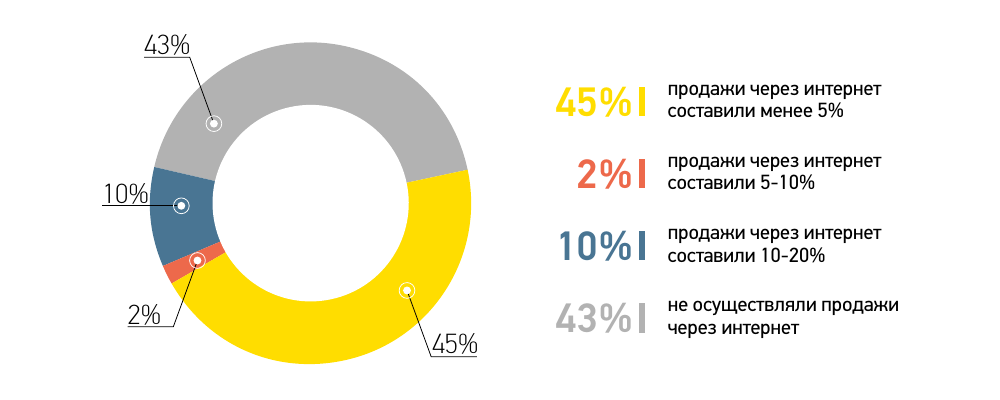

As for the sales of window designs via the Internet, in this issue, although a small but positive dynamics is visible. In most cases, companies still do not sell via the "World Wide Web", or the share of these sales is small - up to 5%. But there are companies that see the potential and develop this direction, such 10%.

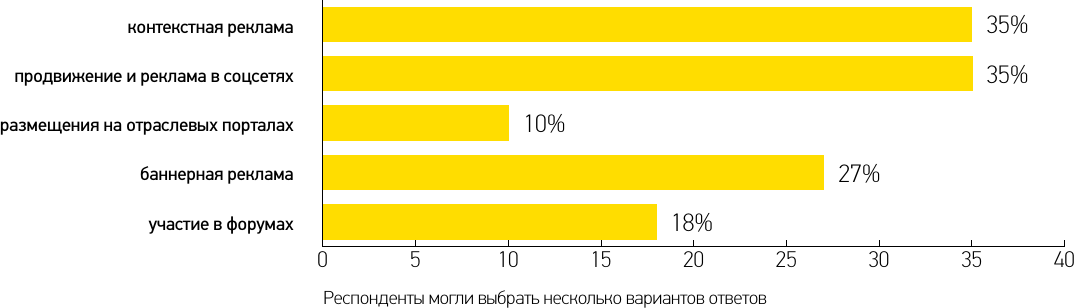

To promote their product and brand on the Internet, companies most actively in the reporting year used contextual advertising in search engines and promotion in social networks. These marketing tools, if properly configured, give fairly fast results and visual indicators. Banner advertising on portals and partner sites was actively used. In addition, participation in forums, the presence on industry portals also took place.

It is worth noting that every year companies are paying more attention to the promotion of their product, brand and shares using these Internet marketing tools, using approximately the same tools, but with greater intensity.

Which tools were the most effective in dealing with dealers in 2017?

How has your company's representation in the regions changed in 2017?

What was the share of online sales in your volumes in 2017?

What Internet marketing tools did you actively use in 2017?

Staff

The development of the window market stimulates the development of its participants. To be stronger than your competitors, you need to develop both your product and your team. Realizing that the cadres decide, if not all, then very much, most of the companies surveyed in 2017 paid due attention to personnel policy, expanding and developing their staff. Almost half of respondents (45%) noted that they increased the number of employees of the sales department in their company.

In general, realizing the importance of personnel in achieving the main objectives of the enterprise, most of the manufacturers of SEC protect their personnel and develop their staff. Moreover, the problem of lack of responsible and highly qualified specialists in this field is always topical.

What is your HR policy in 2017?

If there were changes, did they touch the sales department?

Expectations

Most of the companies surveyed (63%) expect an increase in market volumes in 2018 compared to last year, mainly by 10%. A third of the companies assume that the market volumes will remain at the level of the previous year, and only a tenth of respondents expect a slight decline.

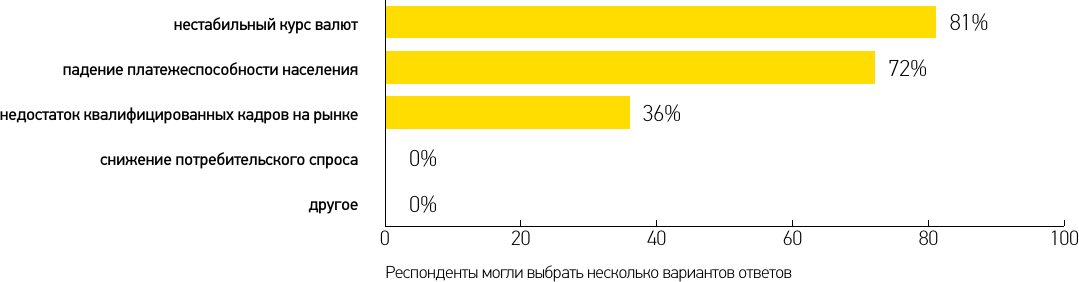

In general, the mood among the polled companies is quite positive. The main concerns of managers of window companies are primarily related to the national currency exchange rate and the solvency of the population, which is understandable.

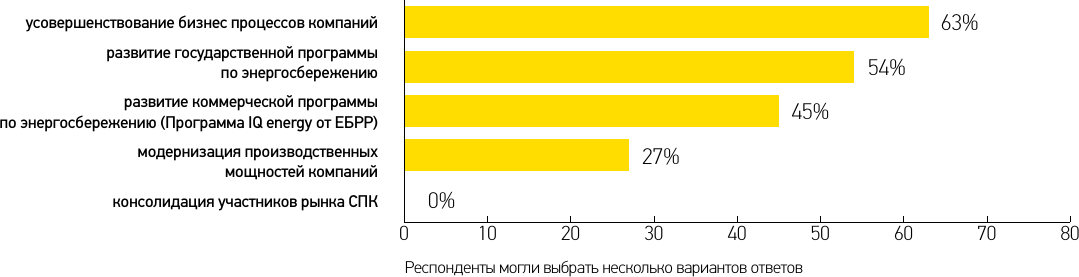

Among the favorable factors in the development of the industry, the companies were identified as external (development of energy saving programs) and internal ones in companies, namely: improvement of business processes, modernization of production capacities of companies, etc.

As to the demand for products in 2018, companies expect that economy-class products will be less popular in the market, while the standard segments will continue to lead in sales. At the same time, some of the companies surveyed are pinning their hopes on premium products, expecting that its popularity will increase in 2018.

"Energy Efficiency" as the main trend, according to respondents, will continue to stimulate the development of the industry. The price of products as a decisive factor that influences the choice of the consumer, goes to the background. Also, companies expect that more functional windows, for example, equipped with basic security elements, will increase in demand.

Quite optimistic expectations of the companies surveyed indicate that the market is ready for a new stage of development, where each of its participants will make its efforts to increase the volume and improve the quality of the product. The main thing is stability in the country.

What is your forecast for the market situation for 2018 versus 2017?

Which segment of components, in your opinion, will be most in demand in 2018?

What do you think will become the main trend among consumers of SEC in 2018?

What, in your opinion, may be unfavorable factors for the development of the industry in 2018?

What, in your opinion, can contribute to the development of the window industry in 2018?