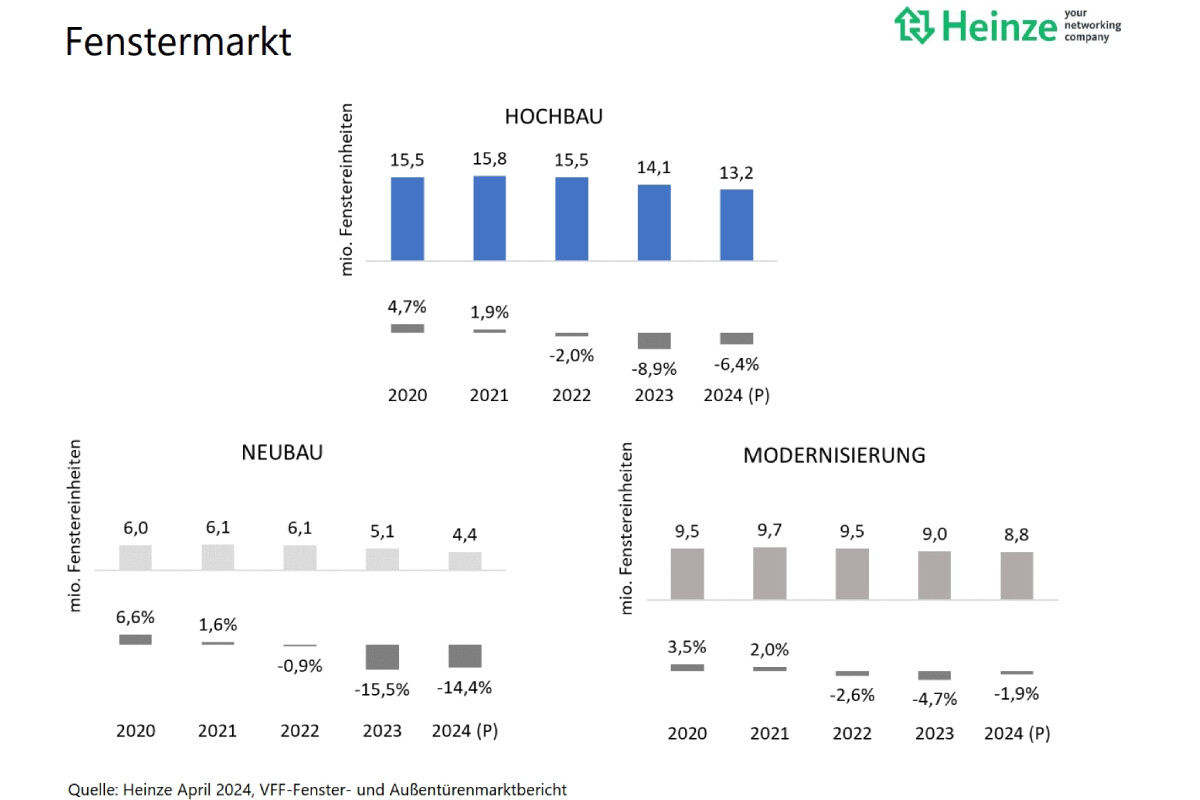

The window market in Germany fell by 8.9% in 2023 and is expected to drop by a further 6.4% in 2024. The external door market decreased by 8.9% in 2023 and is anticipated to shrink by 5.1% in 2024. Forecasts for both segments in 2024 assume that new residential construction will decline by more than 35% in 2023 and 2024 combined. Unfortunately, reality has exceeded the negative forecasts made a year ago.

The Window + Facade Association (VFF) presented the German window and external door market indicators at the VFF Statistics and Market conference in Frankfurt. In addition to the VFF, partner associations such as the Federal Flat Glass Association (BF), pro-K, and the Association of Lock and Fitting Manufacturers (FVSB) also participated in the market research prepared by Heinze GmbH.

Sales of window units (1.3x1.3 m window) will decrease from 15.52 million in 2022 to 14.13 million in 2023 and further to 13.23 million in 2024. Data on residential construction show that reconstruction volumes decreased by 5.4% in 2023 and will decrease by another 2.1% in 2024 to 6.64 million window units. For new construction in the window market, the decline in 2023 is 15.5%. It is expected that in 2024, window sales in new buildings will again decrease by 14.4% to 4.39 million units.

"The need for affordable housing is enormous, as is the need for energy-efficient renovation. The government must provide better framework conditions, reduce bureaucracy, as well as provide better depreciation options for new construction and reconstruction and promote the construction of social housing much more than 'just' with 1 billion euros. An ambitious economic stimulus is needed now," emphasizes VFF Managing Director Frank Lange.

The situation in the external door market is similar. It is expected that the external door market will decline by 5.1% to 1173 thousand units. It is noted that the decline in new residential construction volumes is 15.8% to 188 thousand units. However, the overall volume of renovation will only slightly decrease by 1.9% to 903 thousand units in 2024.

The data is based on a preliminary survey model. The forecast takes into account the consequences of inflation, changes in interest rates, and, overall, the policy framework in regulatory and financial legislation.

Graphics: Heinze/VFF

A brief overview of the German window market as of April 2024

The downturn in the German window and external door markets have continued

ID no: 23158

Feb 3, 2026

Jan 28, 2026

Jan 23, 2026

Today 16:44

Feb 5, 2026