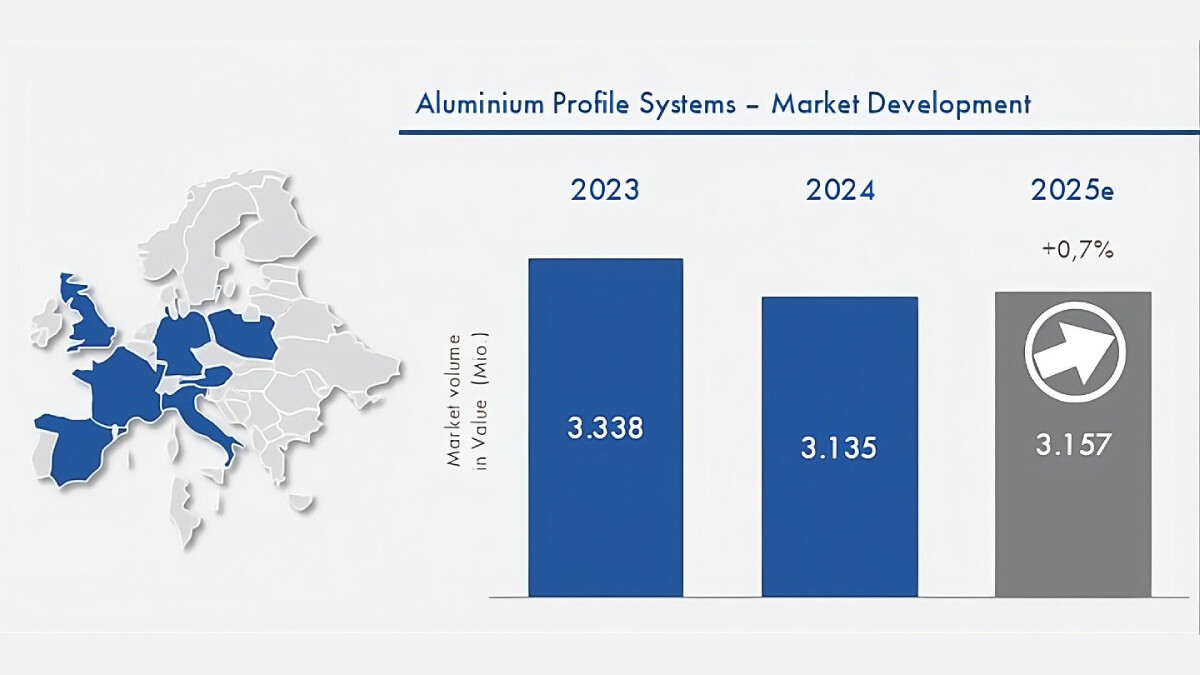

The European aluminium profile systems market is in decline, but expects a recovery from 2025, InterConnection Consulting reports in a new study covering six European countries — Italy, France, Germany, the United Kingdom, Spain and Poland.

Analysts note that after growing to around 518 thousand tonnes in 2023, the market contracted by 4.4% in 2024 to 495 thousand tonnes. In 2025 the decline will continue, with volumes falling by a further 1.8% to around 486 thousand tonnes due to a slowdown in construction activity, inflation and high borrowing costs.

In value terms, the market decreased from €3.3 billion in 2023 to €3.1 billion in 2024. As early as 2025, the study forecasts a return to growth, with average annual growth of 7.0% in 2025–2028 and potential market value of nearly €3.9 billion by 2028.

Spain shows the strongest short-term dynamics thanks to a more active construction sector. Southern European countries will grow faster than the European average. By contrast, Germany as well as the United Kingdom and France have been more strongly affected by the downturn, although from 2025 they will support the recovery phase.

Germany accounts for around 23.1% of total aluminium profile volumes in the top six European countries. In value terms, this market is expected to show the highest growth rates in 2025–2028, with an average annual growth rate of 8.1%.

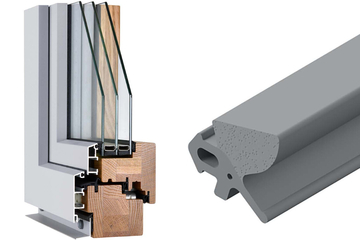

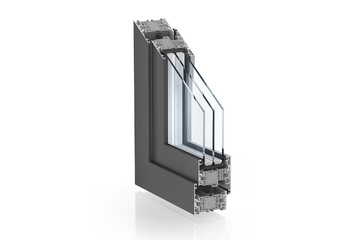

By product, window systems remain the largest segment and will account for around 40% of volumes in 2025. At the same time, demand for them is declining due to weak residential construction. Doors and sliding systems are also showing a slight decline.

Façade systems have demonstrated the greatest resilience during the downturn and from 2025 will lead the recovery. In 2025–2028, their volumes will grow by an average of 4.2% per year, driven by non-residential construction projects and building refurbishment.

On the demand side, the residential segment remains the most vulnerable and will shrink by a further 2.7% in 2024–2025. By contrast, non-residential construction shows greater resilience and will become the main growth driver, with average annual growth of around 4.5% in 2025–2028.

Renovation currently dominates, especially in Southern Europe, but new construction will come to the fore from the middle of the decade. The study forecasts the highest growth rates for this segment — around 6.0% per year in 2025–2028.

More on global trends: The global aluminium market will grow by 6.2% annually until 2032, with construction playing a particularly important role.

Photo: InterConnection Consulting

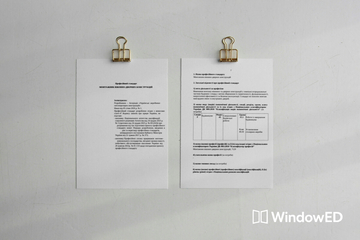

Structure of products and market segments of aluminium profile systems in 2025. Window systems account for 39.9% of volumes, façades for 25.7%, doors for 21.9%, solar shading for 6.5%, sliding systems for 4.8%, and winter gardens for 1.2%.

European market for aluminium profile systems shows short-term weakness and medium-term recovery potential

ID no: 24093

Today 16:44

Feb 5, 2026

Today 21:16

Today 20:09

Today 18:23