The EBRD will provide PrivatBank with a USD 25 million trade finance facility. This will facilitate access to trade finance for Ukrainian companies.

Following the full-scale invasion of russia, access to finance for Ukrainian importers and exporters has been severely restricted, and international banks have avoided the risk of financing trade in Ukraine. The EBRD's own Trade Facilitation Programme (TFP) has supported the recovery of supply chains.

And in March, PrivatBank joined other EBRD partner banks in Ukraine under the TFP.

"Thanks to the EBRD's guarantees, the cost of banking services for documentary operations is significantly lower than for standard loans. This new agreement allows us to issue confirmed letters of credit with post-import financing, which, in turn, enables our clients to extend the period of deferred payment under their foreign trade contracts. We are confident that this large-scale agreement between the EBRD and PrivatBank will benefit all groups of customers who import goods - importers of production equipment, agricultural machinery, machines, machine tools, aggregates, as well as small and medium-sized consumer businesses," said Gerhard Boesch, Chairman of the Board of PrivatBank.

For reference.

The EBRD's Ukrainian TFP partner banks: Deutsche Bank in Ukraine, ING Bank Ukraine, Credit Agricole Bank, Kredobank, OTP Bank, PrivatBank, FUIB, Raiffeisen Bank, Citibank, UKRGASBANK, Ukreximbank, Ukrsotsbank, UKRSIBBANK.

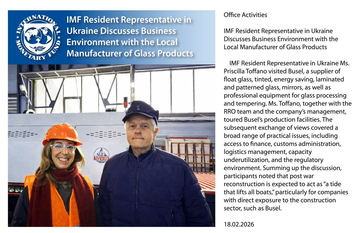

Photo: Приватбанк

EBRD First Vice President Jurgen Rigterink and PrivatBank CEO Gerhard Boesch at the signing of the agreement in Kyiv

EBRD to provide $25 million in trade finance to PrivatBank

ID no: 23102

Today 18:23

Today 16:44

Today 21:16

Today 20:09

Today 18:54