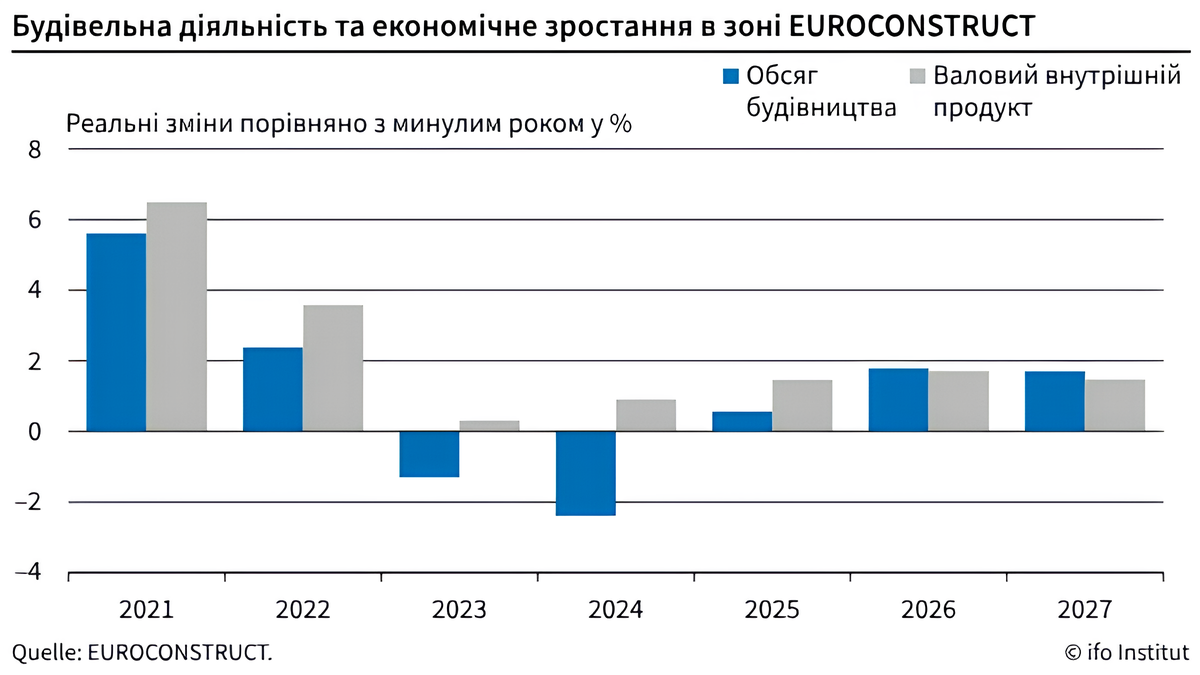

In 2025, the total volume of construction is expected to grow by 0.6%, with recovery rates potentially accelerating to 1.7% in 2026-2027.

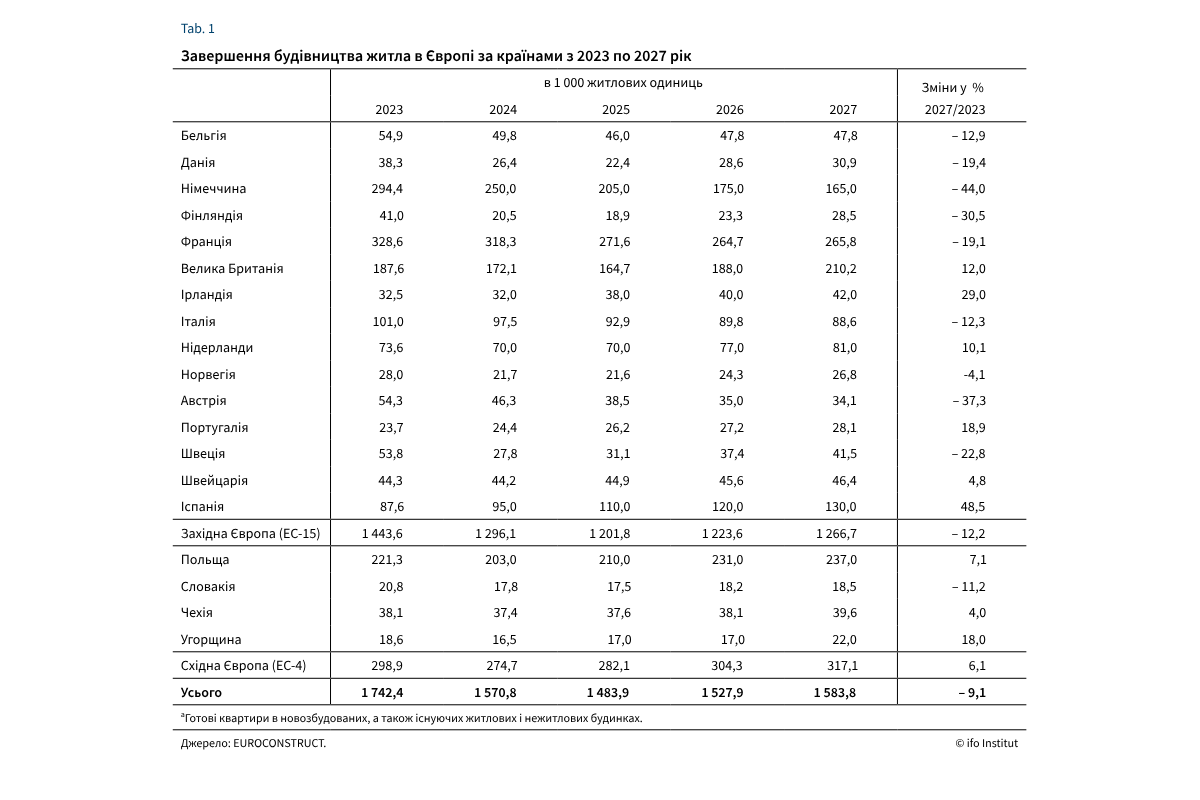

The residential construction sector, which recently underwent significant market correction, will shrink again in 2025, mainly due to a decline in the Italian market. New residential construction remains in a stagnation phase, but gradual recovery may begin in 2026. Meanwhile, non-residential construction is set to return to growth this year after the decline of 2023-2024. The infrastructure construction segment, which has been relatively crisis-resistant, continues to show growth. However, growth rates are expected to slow gradually from 2.2% in 2024 to 1.5% in 2027.

Country-specific outlook:

- Germany: the worst prospects among major markets. Residential construction volume is expected to drop by 44% between 2023 and 2027.

In 2027, only 165,000 apartments are projected to be completed, a 34% decrease compared to 2023. The decline is attributed to high construction costs, labour shortages, high interest rates, and uncertainty in government policies on construction cost reduction measures. - Italy: a sharp surge due to changes in state support programmes for renovations in 2021-2022 has now been followed by a decline.

- France: a significant downturn in the residential sector (-19% by 2027).

- Spain: one of the few markets showing positive growth (+48.5% in residential construction by 2027).

- Poland and the UK: slight growth expected after 2025.

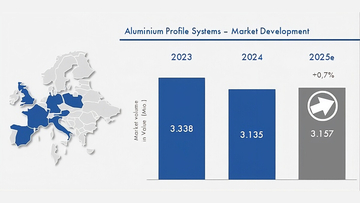

Previously, the German association BV Glass anticipated a recovery in the glass industry by 2025.

In the medium term, moderate acceleration is expected in 2026-2027. However, despite the recovery, a full return to previous growth levels is not guaranteed. Risks include economic downturns, government fiscal constraints, high construction costs, and labour shortages.