In Germany, it is expected that the total volume of the window market will decrease to 12.8 million window units in 2025, down from 15.8 million units in 2021. This forecast was announced at the "Statistics & Market" conference of the German Window and Façade Association Verband Fenster + Fassade (VFF) in October 2024.

It is predicted that in 2024, the German window market will decline by 8.4%, while the market for exterior doors will drop by 9.4%. These changes are part of a general downturn in the construction industry, affecting both new construction and some segments of the repair and modernization market.

High energy prices, low economic activity, and a lack of clarity in construction and infrastructure renewal policies have been named as the main factors contributing to the decline in demand.

A significant drop is expected in the new construction segment. Between 2023 and 2025, demand for new windows and doors in the residential construction sector is expected to fall by 50%.

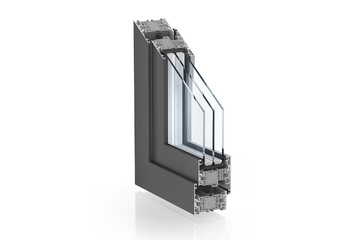

The modernization segment remains stable, with only slight fluctuations. It is expected that by 2025, window modernization will grow. This is supported by the "Climate-Neutral Germany" (IKND) initiative, which aims to fully replace windows older than 1995 by 2045 to help achieve climate goals.

The share of modernization in the total window market is expected to grow to 70% in 2025, compared to 61% in 2021.

VFF experts expect the total window market to shrink to 12.8 million units in 2025, which is 3 million fewer than in 2021. This represents a slight decrease of 1.3% compared to 2024.

The market for exterior doors will also experience a decline: a moderate decrease of 0.4% in 2025 compared to the previous year.

Low investment levels will remain a problem for the German window industry. Both international and domestic demand are under pressure from economic uncertainty. However, VFF points to positive signs for the future, particularly in the area of building modernization with government support. Special programs should provide the necessary incentives for private investment in windows and doors. On the other hand, Eckhard Keill, Director of Roto Frank Holding AG, does not expect German or European politicians to stimulate new construction or renovations in 2025. He suggests focusing on collaboration with organizations and individuals.

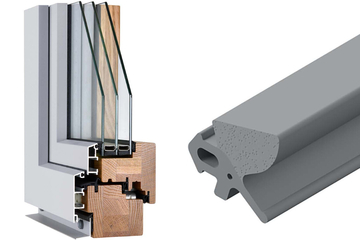

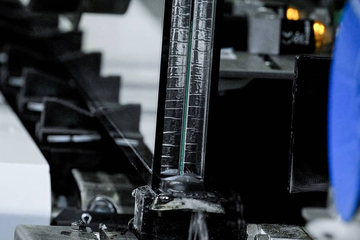

Illustrative photo: Roto Group

In 2025, the German market for windows manufactured after 1995 with a U-value above 2.7 W/(m²K) will be around 200 million units. With annual updates of 9 to 10 million units, these windows can be completely replaced by 2045

German Window and Exterior Door Market: Decline in Volume and Hopes for Modernization

ID no: 23448

Today 18:23

Today 16:44

Today 21:16

Today 20:09

Today 18:54