The commercial risk insurance company Allianz Trade has surveyed global trade expectations. Executives remain cautiously optimistic, although they have less appetite for new markets. Most favour consolidation of existing markets, and 40% of respondents expect the non-payment risk to increase by 2023.

About 3,000 companies engaged in export activities, as well as suppliers and enterprises with production abroad took part in the survey. Seven countries were covered: USA, UK, Germany, France, Italy, Spain and Poland.

Approximately 70% of companies expect export turnover to grow in 2023. In 2022, this number was 80%, and before the full-scale russian invasion, it was 94%.

Every second exporter sees a moderate increase in turnover of +2% to +5%, compared to double-digit turnover growth in 2022.

Companies from the countries most affected by the energy crisis are the least optimistic: Germany, Poland, and Italy.

63% of companies are in favour of increased investment in countries where they are already present, and 56% plan to increase their market share there. Only 47% plan to invest in new countries. American firms are the least interested in the investment. The downturn in global commodity trade that began in October last year has weakened companies’ optimism. The outlook remains weak.

40% of exporters fear an increase in the non-payment risk in 2023. It is particularly noticeable in the UK and Germany (+16% for both countries), while in Italy the increase is only 6%.

Compared to last year, more respondents expect an increase in the timing of export payments (42% vs. 31%).

Global supply chains are not expected to change significantly. Covid-19 and the energy crisis have significantly disrupted companies’ operations and political risks have emerged, but companies have not significantly revised their supply chains. Only 25% have done so since the pandemic, and most have no plans to do so due to the energy crisis. Only about 20% are considering changing location or supplier to reduce environmental and political risks.

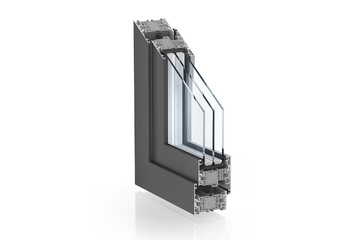

For example, German window brands have hardly left the Russian market, remaining to finance the terrorist country. The situation is even worse for Turkish brands operating in the window market. Of these two countries, the Ukrainian market has the most brands.

Digitalisation and minor adjustments to locations and goals are the most likely resilience strategies.

Companies with a high degree of digitalisation are less affected by shocks. They actively mitigate supply chain disruptions. It is a compelling argument for digital transformation in an era of uncertainty and disruption.

Corporations based in Western Europe prefer Western Europe. American companies prefer the United States. Firms based in Asia Pacific are willing to consider Latin America and Africa for future locations.

Illustrative photo: Paul Teysen on Unsplash

Global trade: roughly 70% of companies expect export turnover to grow in 2023

ID no: 22713

Feb 5, 2026

Feb 3, 2026

Today 18:54

Today 18:23

Today 16:44