In 2024, the European market for exterior shading systems — including roller shutters, venetian blinds, and vertical ZIP screens — shrank by 6.9% in volume terms, according to Interconnection Consulting. The decline was caused by economic pressure, reduced construction activity, and shifting consumer preferences. The market is projected to return to growth from 2026.

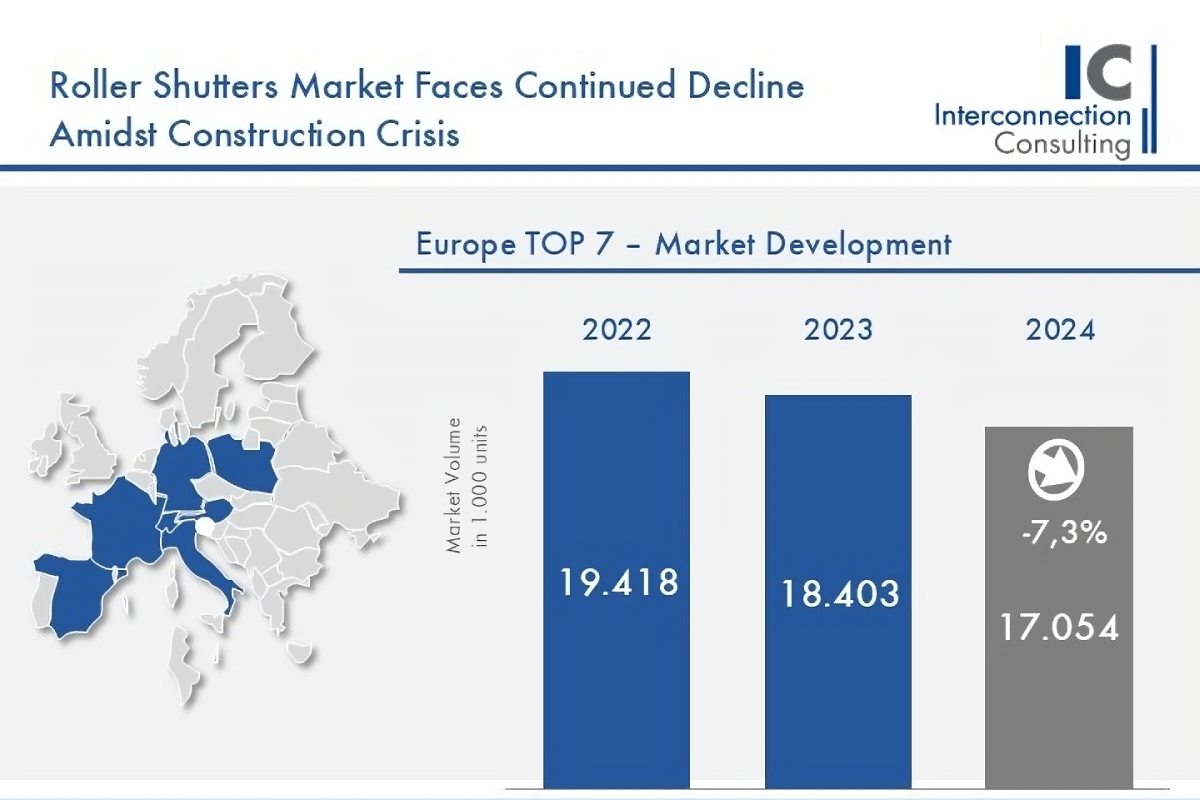

Sales of roller shutters fell by 7.3% in 2024, pushing the market below its 2020 level. Contributing factors included the construction crisis in Germany and France, as well as price drops driven by falling raw material costs, particularly aluminium. Overall market value declined by 9.3%. Prices are expected to rise again from 2025, and by 2027 the market is forecast to stabilise above €2 billion. Demand will be driven by energy-efficient and protective products, although ZIP screens remain a strong competitor.

External venetian blinds or "raffstores" had a difficult year, but Interconnection forecasts an annual sales increase of 4.3% through to 2027. In mature window markets such as Germany, Switzerland and Austria, demand is supported by renovation projects, although this is insufficient to offset the general decline. In contrast, less mature markets like Poland, France and Spain rely mainly on new construction. France stands out in particular, with growing residential demand expected to continue.

Despite the overall downturn in construction, vertical ZIP screens remained stable in 2024 with sales of around 1.1 million units. Their popularity is rising due to versatility — they are also used as side protection for pergolas. Average annual growth is expected to reach 7% in volume and 8.3% in value through to 2027. Germany, Belgium, the Netherlands and Luxembourg together account for nearly two-thirds of total sales.

Also read: 10 golden rules for keeping rooms cool in summer without air conditioning

Photo: Interconnection Consulting

The roller shutter market continues to decline amid the construction crisis

The exterior solar shading market in Europe lost ground in 2024 and expects gradual recovery from 2026

ID no: 23737

Jan 28, 2026

Jan 23, 2026

Feb 5, 2026

Feb 3, 2026